You can access the recording here.

“At Baraka, we’re really driven by the mission of catalyzing private capital to transform the health systems in underserved communities, especially in LMICs [low and middle-income countries], where resources are scarce and all of the investments that have been done have been suboptimal.” – Carolina Batista, Head of Global Health Affairs, Baraka Impact Finance

On July 20 at UCSF, the Bay Area Global Health Alliance hosted Baraka Impact Finance for a conversation on innovative financing for global health in emerging markets. The discussion highlighted the potential of private capital to drive impactful health solutions, the growing interest in impact-focused investments, and the need for greater collaboration between investors, entrepreneurs, and nonprofits to address the challenges faced in global health financing.

“Health spending in low and middle-income countries remains chronically low,” stated James Bair, Baraka’s Partner and Managing Director, who led the discussion with his colleague Carolina Batista, Head of Global Health Affairs.

“The idea that you should start with renovation or uplifting of the public sector in order to drive real solutions and actually meet gaps, needs to be challenged,” he continued, highlighting the growing need for innovative finance mechanisms and private capital to support social impact initiatives and health innovations in low and middle-income countries (LMICs).

To illustrate the challenges many LMIC health innovators face in funding, Abimbola Adebakin, CEO of Advantage Health Africa in Nigeria, explained [via video recording] that her company’s challenges included finding the right investors who understood their business model, dealing with prolonged discussions with potential investors, coping with currency devaluation and inflation, and facing difficulties with accessing funds from banks due to their asset-light business structure. Despite these challenges, Advantage Health Africa has experienced significant growth and added innovations to its model, after raising funding from angel investors and institutional investors, including the Bayer Foundation.

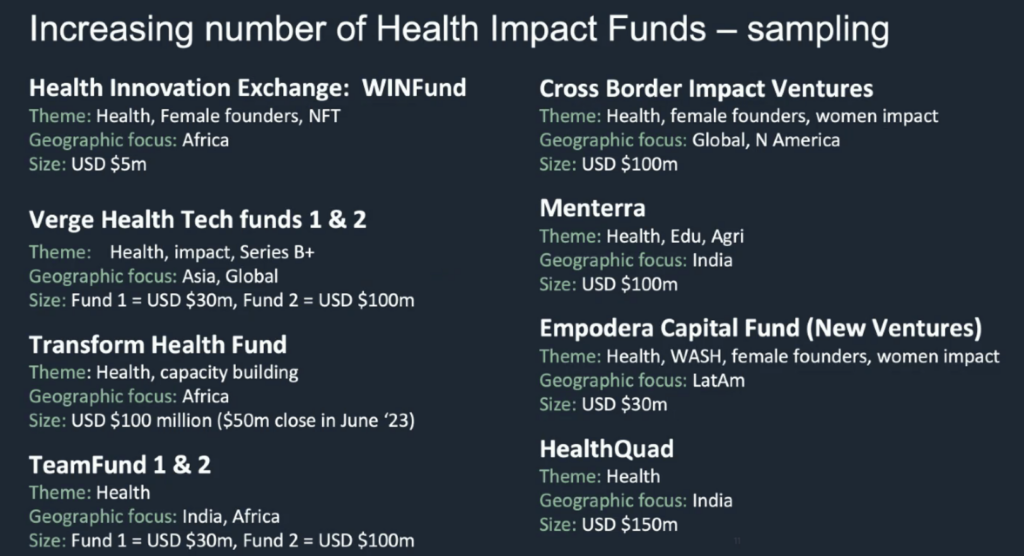

The good news is there is a growing interest in impact-focused investments, as seen by the growth of health impact funds, explained Bair. He gave examples of recent commitments in global health financing made at the G7 Summit and by the World Health Organization (WHO).

The Bill and Melinda Gates Foundation will lead the G7 effort, focusing on primary care and community health and aiming to attract commercial investors to LMICs by applying impact investment principles. The WHO initiative involves the Islamic Development Bank, European Development Bank, and African Development Bank, committing 1.5 billion euros. Their scope of support is also broad and focuses on addressing the funding gap in seed and series A stages of health innovations in emerging markets, Bair informed Alliance members. Many multilateral efforts tend to concentrate on funding series B and above in capital raises, leaving a significant gap at the seed and series A levels.

But large international NGOs to smaller companies in low-income countries are still struggling to transition to business performance approaches that will help attract investors, commented Bair.

Baraka is developing a health investment intelligence dashboard to provide visibility into funding opportunities and enable dialogue between stakeholders, profiling companies in the health sector with a focus on technology-driven solutions in emerging markets. Baraka serves as a broker and “connects the dots between private wealth and innovation.”

For nonprofits or NGOs looking to attract private capital, Bair recommends evaluating your organization with a business lens, taking time to evaluate how your organization’s impact could be framed in business terms, and using private sector language.